XRP Price Prediction: Analyzing Technical Indicators and Market Catalysts for 2025

#XRP

- Technical indicators show XRP trading above key moving average with Bollinger Band resistance at $3.1786

- First US spot ETF approval and institutional partnerships driving positive market sentiment

- MACD analysis suggests potential momentum shift despite current bearish crossover pattern

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

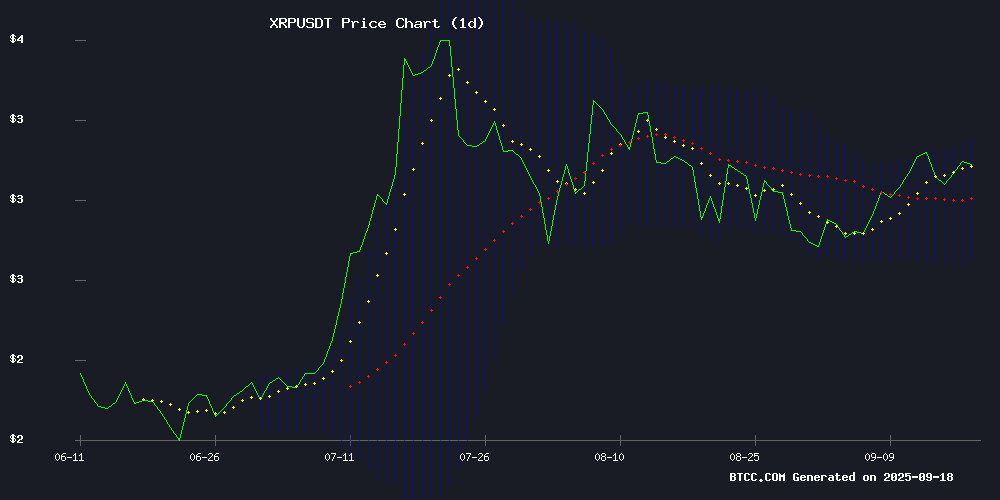

XRP is currently trading at $3.1043, positioned above its 20-day moving average of $2.9385, indicating underlying strength. The MACD indicator shows a bearish crossover with values at -0.1195 (MACD line) and -0.0402 (signal line), though the histogram at -0.0793 suggests potential momentum shift. Bollinger Bands reveal price action NEAR the upper band at $3.1786, with middle band support at $2.9385 and lower band at $2.6985. According to BTCC financial analyst Emma, 'The current technical setup suggests XRP is testing resistance levels while maintaining support above key moving averages, which could signal consolidation before potential upward movement.'

Market Sentiment: ETF Approval and Institutional Adoption Fuel XRP Optimism

Recent developments including the first US spot ETF approval and partnerships with major financial institutions like DBS, Franklin Templeton, and Ripple are driving positive sentiment. BTCC financial analyst Emma notes, 'The combination of regulatory clarity through SEC approval and growing institutional adoption creates a fundamentally strong environment for XRP. The ETF debut has generated substantial investor interest, while partnerships enhancing tokenized liquidity on XRP Ledger demonstrate real-world utility.' Market expectations are leaning toward continued momentum, with technical breakouts potentially targeting the $3.30-$3.50 range, supported by favorable macroeconomic conditions including potential Fed rate cuts.

Factors Influencing XRP's Price

XRP Gains Momentum as First US Spot ETF Draws Strong Investor Interest

XRP's price surged following the launch of the first U.S. spot ETF tied to the cryptocurrency, with the Rex-Osprey XRP ETF attracting $25 million in trading volume within 90 minutes of its debut. Bloomberg analyst Eric Balchunas described the demand as "semi-shock," noting it exceeded initial expectations by fivefold compared to XRP futures ETFs.

The token climbed 2% to $3.11, though still 15% below its July peak of $3.65. Market sentiment suggests potential for further upside, with some traders anticipating a rally toward $4. The ETF's strong start signals growing institutional acceptance of XRP despite its ongoing regulatory challenges.

XRP Price Prediction: Can the Rally Hold?

XRP surged 3.33% to $3.12, extending weekly gains to 7.5% as trading volume spiked to $7.78 billion. The breakout from a multi-week consolidation phase signals strengthening momentum, with technical indicators turning bullish.

Key resistance at $3.08-$3.09 is being tested repeatedly after holding support at the psychological $3.00 level. Analysts identify a bull flag pattern that could propel prices toward $3.50, with longer-term targets at $5 and potentially $10 if buying pressure sustains.

Institutional interest appears robust, with one-minute flows hitting $27 million according to Flatleak data. The rally coincides with broader market optimism, though traders are increasingly monitoring emerging tokens like Bitcoin Hyper for pre-listing opportunities.

XRP Gains Bullish Momentum With Eyes on $3.30 Breakout

XRP trades at $3.10, marking a 3.2% increase over the past 24 hours as trading volume surges 62.12% to $7.36 billion. The token demonstrates resilience with a 3.01% weekly gain despite broader market volatility.

Technical indicators reinforce bullish sentiment—the RSI at 58.26 and MACD data suggest room for further upside. Analysts identify $3.03 as critical support, with a breakdown potentially testing $2.85. Conversely, a close above $3.20 could signal momentum toward the $3.30 breakout level.

XRP Price Surges as ETF Debut & SEC Rule Shift Spark Breakout Momentum

XRP has surged to $3.12 amid bullish momentum fueled by regulatory breakthroughs and institutional interest. The SEC's approval of streamlined crypto ETF listings under the '33 Act removes barriers for spot ETFs, provided the underlying asset has futures on Coinbase. This shift could pave the way for XRP and a dozen other cryptocurrencies to gain ETF-based market access.

Wall Street's debut of an XRP ETF and a 0.25bps Fed rate cut further amplify optimism. The token's price action reflects a decisive breakout from a descending triangle pattern, signaling strong institutional demand for regulated exposure vehicles.

XRP Price Prediction: XRP Eyes $5 After Fed Rate Cut Decision as Analyst Signals Bullish MACD Crossover

Ripple's XRP is capturing market attention as technical indicators suggest a potential breakout. A bullish MACD crossover, highlighted by analyst @Steph_iscrypto, historically precedes upward trends. Fidelity research corroborates this pattern, noting its significance when the MACD crosses above zero.

Despite recent volatility—with XRP posting a 2.7% gain over 24 hours on September 18, 2025—the token shows resilience. Analysts draw parallels to the 2017 bull run, where XRP peaked near $2.13, and speculate a "mega cycle" could propel prices toward $5.

Market participants are monitoring key support levels, with heightened trading activity signaling sustained interest. The Fed's rate cut decision adds macroeconomic tailwinds, further fueling optimism for XRP's trajectory.

DBS Partners with Franklin Templeton and Ripple to Enhance Tokenized Liquidity on XRP Ledger

Asia’s largest bank, DBS Group Holdings, has teamed up with Franklin Templeton and Ripple Labs to introduce new trading and lending solutions on the XRP Ledger. The collaboration, formalized through a memorandum of understanding signed in Singapore, targets accredited and institutional investors. Nearly 87% of institutional investors anticipate allocating to digital assets by 2025, according to a survey cited by DBS.

The agreement enables investors to swap tokenized shares of Franklin Templeton’s U.S. dollar money market fund (sgBENJI) for Ripple’s USD stablecoin, RLUSD. This move aims to enhance liquidity and market efficiency, allowing 24/7 portfolio rebalancing into stable assets with yield. The pairing bridges regulated stablecoins with tokenized fund shares, offering investors a seamless way to lock in principal and earn returns.

DBS Digital Exchange (DDEx) has listed sgBENJI alongside RLUSD, facilitating round-the-clock trading between a dollar stablecoin and a cash-equivalent fund. The underlying money market fund holds approximately $736 million in short-term government securities, providing a robust foundation for the new offering.

XRP Eyes Strong Upswing Toward $3.50 After SEC ETF Approval

XRP is regaining momentum as investor interest surges, with technical analysis suggesting a potential rally toward $3.50. The token's revival follows broader market optimism fueled by regulatory developments.

The SEC's approval of generic ETF listing standards removes barriers for crypto-based ETFs, eliminating the need for individual product approvals. This regulatory shift opens new avenues for institutional investment in digital assets.

Currently trading at $3.08 with a $184.90 billion market cap, XRP has seen 2.17% growth in 24 hours. Trading volume stands at $10.32 billion, reflecting renewed market activity.

Will Ripple Be the Death of SWIFT?

Ripple's blockchain-based payment system is increasingly viewed as a formidable challenger to SWIFT's legacy infrastructure. Analysts argue that Ripple's efficiency in cross-border transactions could render SWIFT obsolete as financial institutions migrate toward decentralized solutions.

The debate centers on Ripple's potential to disrupt SWIFT's dominance by offering faster, cheaper settlements. A crypto analyst noted, "SWIFT is old. As liquidity moves on-chain, Ripple won't just compete—it will replace." The shift coincides with SWIFT's ongoing ISO 20022 migration, a race where Ripple already holds technical advantages.

Pepenode Community Eyes XRP Tundra Presale for Rapid Return Potential

Pepenode's meme-driven presale has emerged as a standout in 2025, blending token sales with gamified mining mechanics. Participants purchase virtual nodes, burn tokens for efficiency boosts, and earn meme coin rewards—a model that's cultivated both capital inflow and retail investor loyalty.

With presale momentum building across the sector, Pepenode's community is now scrutinizing XRP Tundra's newly launched offering. The project's fixed $0.30 entry price, dual-token architecture, and planned staking features are drawing comparisons to Pepenode's early growth trajectory.

What makes Pepenode compelling—scarcity through burns, tiered pricing advantages, and participatory rewards—now serves as a benchmark for evaluating emerging opportunities. The market watches whether XRP Tundra can replicate this alchemy of engagement and tokenomics.

Ripple (XRP) Gains Momentum as Technical Indicators Signal Potential Breakout

XRP surged 3.95% to $3.13, fueled by bullish technical indicators and broader market optimism. The token's RSI at 59.63 suggests room for upward movement, while a strong MACD histogram reinforces growing momentum.

Absent major fundamental catalysts, price action appears driven by technical factors. XRP has maintained steady gains year-to-date, holding well above its 52-week low of $1.80. Traders now eye a potential breakout above the $3.38 resistance level.

Mint Miner Touts Cloud Mining as XRP ETFs Approach US Debut

The cryptocurrency market braces for a pivotal moment as the first US spot XRP ETFs prepare to launch, signaling growing institutional acceptance of Ripple's digital asset. Mint Miner, a cloud mining platform, seeks to capitalize on this momentum by offering XRP holders AI-driven passive income opportunities.

Mint Miner's value proposition centers on converting XRP holdings into daily mining rewards through smart contracts. The platform emphasizes its use of clean energy and transparent operations, positioning itself as a complementary tool for investors seeking to maximize returns beyond ETF participation.

This development comes as the crypto industry observes increasing convergence between traditional finance instruments and blockchain-native yield generation strategies. The ETF listings are expected to enhance XRP's liquidity and price stability while Mint Miner targets those looking for additional yield streams.

Is XRP a good investment?

Based on current technical indicators and market developments, XRP presents a compelling investment opportunity. The cryptocurrency is trading above its 20-day moving average with strong institutional backing through recent ETF approvals and major banking partnerships. The technical analysis suggests potential upward movement toward $3.30-$3.50 resistance levels.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $3.1043 | Neutral/Bullish |

| 20-Day MA | $2.9385 | Support Level |

| Bollinger Upper | $3.1786 | Resistance |

| MACD Histogram | -0.0793 | Watch for Crossover |

BTCC financial analyst Emma suggests that 'investors should monitor the $3.30 breakout level and consider the strong fundamental support from institutional adoption and regulatory developments.'